Table of Content

This analysis found that common annuity rates reached a 14-year excessive in October. As of this month, the typical annual annuity revenue stands at £3,one hundred ninety, rising by £898 for the rationale that begin of the yr. The common annual annuity incomerose by £898 because the begin of 2022, according to Moneyfacts knowledge. Many of us have spent the previous couple of decades planning and carefully saving for the issues that are necessary to us, whether that’s life’s luxuries, our mortgages and bills, or our plans for the longer term. As we grow old we'd have different priorities, however our monetary planning for retirement should be simply as necessary. 1Legal & General average direct annuity charges for ages 65, 70, 75 and 80.

Annuity.org content is meticulously reviewed to make sure it meets our excessive requirements for readability, accuracy, fairness and transparency. A few simple steps was once sufficient to regulate monetary stress, but COVID and pupil loan debt are forcing individuals to take new routes to financial wellness. Only one IRA rollover to another account can be completed inside any one-year interval.

Get 5 Free Video Lessons With Uncommon Insights To Speed Up Your Financial Progress

It’s centered on opening entry to unbanked and underserved communities, including the Latinx neighborhood. The NHCOA is aimed specifically at older members of the Hispanic community and provides various programs, resources and advocacy. UnidosUs is the most important Hispanic civil rights and advocacy organization in the united states The organization offers a lot of data and research on topics that vary from economic to political and is affiliated with many community-based organizations. Financial literacy can play a job in helping to better understand some of these situations and the potential drawbacks of opting for risky financing options.

Read extra about Deferred Lifetime Annuities within the following section. Today, Canada remains to be the home to many Indigenous, First Nations, Inuit, and Metis peoples from all across Turtle Island. We are grateful to have the chance to work in this territory. We perceive and respect that your lived experience and gender alternative may be completely different than your assigned sex at birth.

Not Sure Of Your Tax Rate?

Annuities ought to be evaluated within the context of your detailed long run monetary plan. Will be ready to match the annuity to past age a hundred — but only the annuity earnings is assured for all times. In this instance, the RRIF revenue exceeds the annuity income for a time period because of the mandatory minimal withdrawals. When you’re planning for retirement, it’s essential to have a good idea of how much earnings you’ll need while you’re not working and the place that money will come from.

This implies that after the first one passes away, UNREDUCED funds will proceed to the surviving partner. Some components to consider are your time horizon, monetary targets and danger tolerance. Because annuities — and funds normally — can be sophisticated, it’s necessary to talk to a professional who might help you evaluate your retirement portfolio and explain your monetary choices. Chris Magnussen, licensed insurance coverage agent at Annuity.org, explains why an annuity can make for a good investment. After you’ve chosen your annuity provider and determined the phrases of the contract, you’re ready to buy. Marguerita M. Cheng, CFP®, CRPC®, RICP®, is the chief government officer at Blue Ocean Global Wealth.

This annuity calculator will estimate how a lot revenue you might get and examine it to revenue from a GIC or RRIF. It is worth mentioning that there exists a subset of fastened annuities known as multi-year assure annuities that work a bit in another way from traditional fixed annuities. Traditional mounted annuities earn interest based on a fee that's guaranteed one 12 months at a time, with a minimal assured fee that it can't drop beneath. In contrast, MYGAs pay a specific proportion yield for a certain period of time. MYGAs are a lot like Certificates of Deposit , besides that they have tax deferral benefits, higher time horizons, and are usually purchased with a lump sum of funds. An MYGA's price of return is mostly similar to that of 10 or 20-year treasury bonds.

Vice versa, if you are utilizing a Traditional IRA, the payments shall be fully taxable. For instance, say you each died and only $300k had been paid to you. The insurance firm would pay the $100k steadiness to your beneficiaries. Monthly earnings of $1,977 will be paid to you and your wife for as lengthy as either of you resides.

Might Now Be The Most Effective Time To Buy A Pension Annuity?

They also are usually useful for extra conservative traders or individuals who want a way to management their spending via regulated, regular money flows. Despite an enchancment to the average annual annuity income, retirees could properly go for drawdown because of the flexibility. Those who remained totally invested in a pension would likely observe the impression made on pots during stock market volatility in 2022. To find one of the best pension annuity rates, UK savers ought to compare the market and see what’s presently available.

The NewRetirementRetirement Calculatorcan help you assess your annuity determination. This device will let you make a decision with your total retirement plan in thoughts. An advisor may help you weigh your options and select the strategy that can work greatest for you. The firm might help you discover the best insurance coverage agent for your unique financial objectives. Please seek the recommendation of a certified skilled before making monetary selections. This process is like constructing a traditional budget, however there are another components to consider when budgeting for retirement.

When Is The Present Value Of Annuity Calculator Used?

If you’re retired or planning to retire soon, it’s a great time to look into an annuity. As a substitute for buying an immediate annuity with a COLA, you may also stagger your purchases. In different phrases, you ought to purchase additional instant annuities down the street, as needed, to cowl increases to your residing bills. This methodology is particularly useful if interest rates are also rising during your laddering interval. We are contemplating purchasing a non certified instant annuity with a pay in of $250,000 to $300,000. I have read professionals and cons of constructing in a 3% annual increase with some authors writing that the price doesn't justify the profit under both situation.

While a lot of the financial literacy problems that the rising group faces can't be solved in a single day, one urgent area surrounds housing. The stigma round taking up debt throughout the community has helped contribute to lower credit score scores. This drawback could also probably develop as the Latinx group makes up a larger and larger share of the U.S. According to the Pew Research Center, the Latino inhabitants reached sixty two million in 2020. That development has been fast, with only 35 million Hispanic Americans as lately as 2000. The concern of outliving your savings is actual for even the wealthiest subsections of the U.S., and Hispanics face the double-edged concern of already typically lacking savings and dwelling longer on common.

Run a situation with or without an annuity and assess your money circulate, out of cash age, estate worth and more. An annuity operating over 20 years, with a starting principal of $250,000.00 and development price of 8% would pay approximately $2,091.10 per month. For RRIFs, for ages seventy two and higher, withdrawals are the higher of the annuity revenue; or the RRIF minimal withdrawal. For RRIFs, for ages seventy one and decrease, withdrawals are set equal to the annuity revenue. The device assumes the client converts registered belongings to a RRIF at age seventy one.

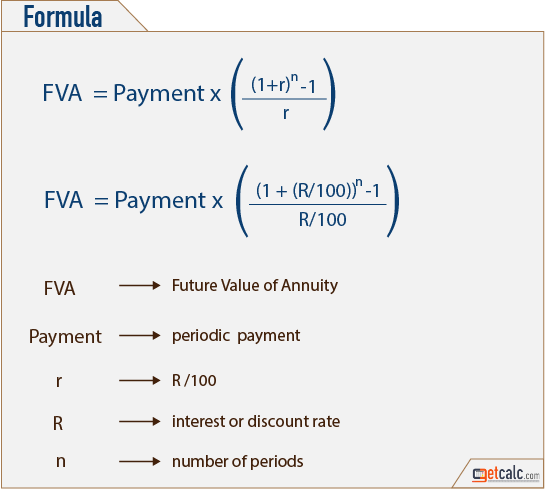

Ebony has a deep information of the monetary landscape and a background in accounting, private finance and revenue tax planning and preparation. Payment/Withdrawal Frequency – The payment/deposit frequency you want the current worth annuity calculator to use for the present value calculations. The interval could be monthly, quarterly, semi-annually or yearly. Annual Interest Rate (%) – This is the rate of interest earned on the annuity.

About Blueprint Income

For non-registered funds, GIC withdrawals are set equal to the annuity income. An annuity is simply one piece of your complete retirement earnings image. For assist fitting the pieces together, review your outcomes with an advisor. Find out how an annuity may give you a assured earnings for all times. You can read extra about our dedication to accuracy, equity and transparency in our editorial pointers.

No comments:

Post a Comment